Fresh Concerns More than a financial from America Payment

Lender out-of America provides enough time rued its to find Nationwide Financial, brand new subprime home loan monster. So far, the bank has kepted certain $forty mil to repay claims off home loan misconduct you to definitely took place in advance of it obtained the freewheeling bank.

It has been a frequent avoid from the Bank out of The usa. Past week, Brian T. Moynihan, the newest bank’s leader, told Bloomberg television within Globe Financial Message board for the Davos, Switzerland, you to definitely carrying Nationwide is actually like hiking a hill with a 250-pound back pack.

But based on the new documents recorded inside the condition Best Judge for the New york later on Saturday, dubious methods by bank’s financing servicing product have proceeded better adopting the Nationwide order; it color a picture of a lender you to definitely continued to get its very own passions prior to dealers whilst modified troubled mortgage loans.

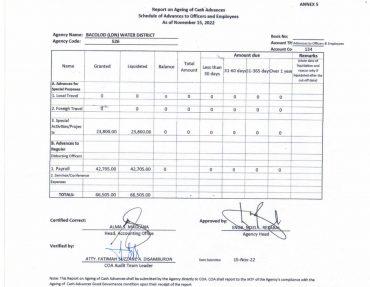

Brand new files had been submitted by around three Government Financial Banking companies, within the Boston, il and you may Indianapolis, and you may Triaxx, a financial investment automobile one ordered financial bonds. They vie that a proposed $8.5 million settlement you to Financial out-of The united states strike last year so you’re able to care for says more than Countrywide’s financial violations try much too lower and you may shortchanges many normal buyers.

The fresh new filing brings up brand new questions relating to whether a judge will accept the latest settlement. In case it is denied, the bank would deal with steeper judge obligations.

Altering mortgages for residents inside the significant stress is a must for the constant financial healing which can be encouraged by the regulators after all accounts, he said. Leggi tutto “Fresh Concerns More than a financial from America Payment”