Home ownership are an aspiration of several The brand new Zealanders. Taking out a home loan is the first rung on the ladder to help you reaching which mission however, if you don’t pay everything borrowed, your house ownership stays in partnership with the fresh new financing human anatomy.

People, challenge i state most, see it better to spend than help save. But really saving for the short term is also 100 % free finance regarding long run. However in which age of quick gratification, we quite often clean out attention of the a lot of time games.

Living obligations free is also a common point. Since your mortgage is most likely their greatest debts, it does really help debt condition when you’re in a position to decrease so it debt as fast as possible.

Your residence mortgage comprises of several areas – dominant and interest. The main is the matter you borrowed from and should pay back, in addition to focus is the amount the lending company costs for lending you the money.

Brand new offered you take to settle the primary, more interest you will spend. Effortlessly the new prolonged the expression of your own financing, the greater it costs you. If you take aside a loan with a payment name of 3 decades, nevertheless pay it back less, it can save you a heap into the attract.

Envision what you are able perform into the even more dollars monthly. You could use the cash having investments, home improvements, to journey to amazing attractions, otherwise follow most other goals. Is it possible to pay-off your residence loan quicker?

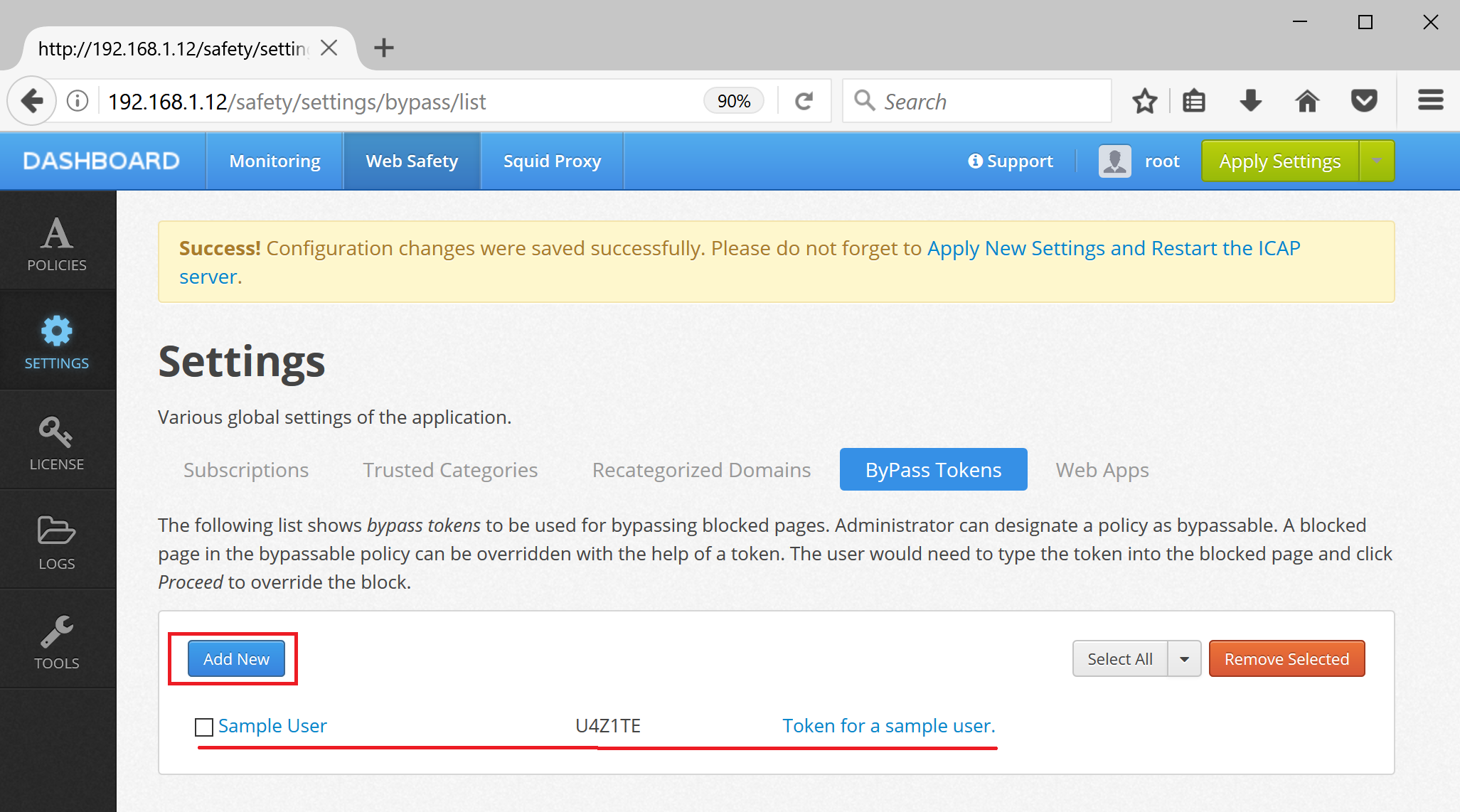

Ahead of putting extra cash at your home loan, you need to be yes you understand how their mortgage works. Could it possibly be a predetermined speed, drifting rate or rotating borrowing financing? You must know exactly how flexible your home loan is actually and stay along the advantages and disadvantages of the more repayment valuable hyperlink structures. Leggi tutto “8 strategies for paying your own mortgage out of faster”