- 1. Decide what we need to escape the fresh new refinancing procedure

- 2. Evaluate the money you owe

- step three. Search for a knowledgeable pricing

- cuatro. Apply to re-finance which have several lenders

- 5. Like your own bank and refinance terminology

- 6. Proceed through an appraisal

- 7. Romantic on your own refinanced financial

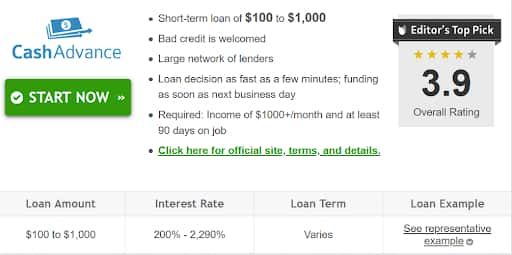

Insider’s experts pick the best services to create wise behavior together with your currency (here is how). In some cases, we discovered a percentage from our our lovers, yet not, our opinions is our own. Words apply to now offers listed on this page.

- Once you refinance your house, you are taking away home financing with a new rate of interest and you can name length.

- Evaluate whether your profit are located in adequate shape to begin with the fresh refinancing process.

Your refinance home financing when you wish to remain in the fresh new exact same family, however with some other home loan words. Of the refinancing your own financial, you are taking aside yet another financial to replace the dated you to definitely.

The new refinanced home loan may come with various conditions. Including, you might button regarding a variable rates to a fixed one to, or away from a 30-year financing to help you good fifteen-seasons loan. The latest financial may also have a unique rate of interest.

step one. Decide what we would like to get free from the refinancing processes

Contemplate the reason why you should refinance, and what might make the refinancing techniques worth your energy. Such as, maybe you want to re-finance to own less speed, you determine you happen to be merely comfy this in the event your new speed might possibly be about step 1% all the way down. Leggi tutto “7 strategies so you can refinancing your own mortgage, out of establishing economic requires to help you closure on your own new financing”