- 1. Decide what we need to escape the fresh new refinancing procedure

- 2. Evaluate the money you owe

- step three. Search for a knowledgeable pricing

- cuatro. Apply to re-finance which have several lenders

- 5. Like your own bank and refinance terminology

- 6. Proceed through an appraisal

- 7. Romantic on your own refinanced financial

Insider’s experts pick the best services to create wise behavior together with your currency (here is how). In some cases, we discovered a percentage from our our lovers, yet not, our opinions is our own. Words apply to now offers listed on this page.

- Once you refinance your house, you are taking away home financing with a new rate of interest and you can name length.

- Evaluate whether your profit are located in adequate shape to begin with the fresh refinancing process.

Your refinance home financing when you wish to remain in the fresh new exact same family, however with some other home loan words. Of the refinancing your own financial, you are taking aside yet another financial to replace the dated you to definitely.

The new refinanced home loan may come with various conditions. Including, you might button regarding a variable rates to a fixed one to, or away from a 30-year financing to help you good fifteen-seasons loan. The latest financial may also have a unique rate of interest.

step one. Decide what we would like to get free from the refinancing processes

Contemplate the reason why you should refinance, and what might make the refinancing techniques worth your energy. Such as, maybe you want to re-finance to own less speed, you determine you happen to be merely comfy this in the event your new speed might possibly be about step 1% all the way down.

2. Determine your financial situation

Just as after you took out your first financial, you will want an effective monetary profile to own refinancing become well worth their when you are. See your bank account to determine if your will get a whole lot now or you is waiting.

You will need to discover your security commission. An easy way to shape it aside is always to estimate their loan-to-worthy of ratio, or how much you will still are obligated to pay instead of how much cash your home http://www.paydayloansconnecticut.com/moodus is really worth.

To estimate your LTV proportion, split the quantity due (in this instance, $a hundred,000) from the home well worth ($175,000). You’ll receive 0.571, or 57.1%.

To locate the guarantee payment, subtract your own LTV ratio off one hundred. After you deduct 57.1% away from 100%, your full try 42.9%. You may have 42.9% equity of your home.

Of several lenders would like you for at the very least 20% guarantee having a profit-out re-finance, you might be able to refinance having a lowered payment if you have an excellent credit history and you may a reduced loans-to-earnings ratio, or if perhaps you may be creating an increase-and-label re-finance. There are even numerous an effective way to enhance your household equity just before refinancing.

Understanding your financial situation will allow you to learn which kind of refinance you qualify for, and exactly how an excellent off a speeds you will get.

step three. Buy the best costs

Simply because your financial offered you the reduced interest on the first mortgage doesn’t necessarily indicate it can give you an educated contract the following big date around.

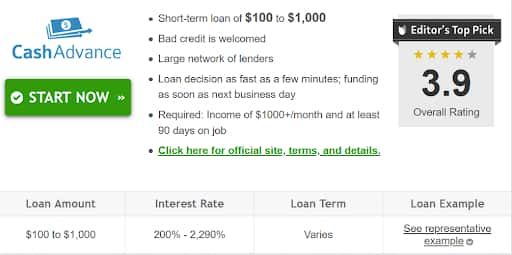

Search loan providers to determine who’s offering the most useful pricing at this time. You could lookup organizations by way of mortgage investigations other sites, get in touch with lenders myself, otherwise use a mortgage broker since your middleman.

4. Connect with refinance having several lenders

Delivering preapproval emails regarding numerous people lets you compare rates of interest alongside. If you request an itemized directory of fees out-of for every single team, then you might discover a lender one to charge a slightly large rates will save you cash in the new short-term by the charging you smaller to summarize fees. Then you may pick if this matches your financial desires so you’re able to squeeze into the lower speed or lower fees.

After you apply for preapproval, a lender really does a painful credit query to ascertain the credit history; the fresh new query will be on your credit report that can temporarily apply at your credit score. A lot of tough inquiries on your statement normally hurt the credit rating – unless of course its in the interests of looking an educated speed.

For folks who limit your rates searching to help you a month approximately, then credit agencies usually remember that you are searching for a home loan and you will must not hold everyone query against your.