During the Federal Homeownership Day, Nations Next step try providing some body navigate renovation investment and getting 100 % free information for everybody levels off homeownership.

- /

- Information

- /

- Countries Step two Survey Finds out Us citizens Try Even more Prioritizing Home improvements To Increase Household Worthy of

These programs discuss various type of financing and you may mortgages, home loan rescue options, helpful tips towards the establishing and you can keeping good credit, and dependence on credit towards overall monetary health

- Finance

Throughout the National Homeownership Few days, Nations Second step are helping individuals browse repair funding and you can getting free information for everybody level from homeownership.

BIRMINGHAM, Ala., /CSRwire/ – Nations Lender towards the Wednesday established the results away from a different sort of homeownership survey that finds out a growing number of men and women are renovations its house in order to boost the worthy of. It appear since homebuying sector stays extremely aggressive, which includes people deciding to revise its latest homes as opposed to select an alternate family.

June try National Homeownership Day, while the survey is used by the Countries Next step, this new bank’s no-pricing economic training system one to provides folks of all age groups, whether or not it lender that have Regions. With regards to the survey, nearly half of (48%) out-of U.S. property owners state they are likely to create reputation on their current home in order to increase their worth throughout the coming season. So it contour is right up seven % versus this time around history 12 months.

On top of that, more youthful home owners try really into taking on a restoration or remodeling project. Seventy percent of them within age of 18 and 34 is likely to make reputation compared to 52% of them many years thirty five-54 and you can forty% of them years 55+.

As the Americans all the more redesign their houses, teaching themselves to make use of house equity to invest in ideas was rising. With regards to the survey, 42% getting knowledgeable about such resource choices weighed against 38% away from participants just who felt on the know about the help of its home’s security just last year.

Inside a competitive housing market, some body still have an abundance of solutions, including the help of its residence’s security to support a repair or extension of the most recent family, said Michelle Walters, head out-of Mortgage Manufacturing during the Places Lender. All of our home loan and part-banking teams work with property owners you to-on-one mention their alternatives and construct a financial roadmap to your finding their requirements. Be it a remodelling or an alternate family pick we discover which is beneficial consult an economic elite group and you may choose your options that will be right for you.

This type of programmes discuss the many sort of loans and you will mortgages, mortgage relief solutions, a guide to your establishing and you can maintaining solid borrowing, therefore the dependence on credit into total monetary fitness

- Renters need to the long term; nearly one in about three (30%) propose to get property within the next one year.

- Cash would be the biggest traps so you’re able to homeownership. Thirty-1 percent cited finding an affordable home and another 30% listed rescuing adequate currency to have a deposit given that biggest monetary barriers. Out-of participants old 18-34, 41% cited looking for an affordable house and 39% indexed preserving enough currency to possess a downpayment as their ideal barriers.

- Forty-five per cent out of People in the us become familiar with all round homebuying procedure. Nevertheless they getting more experienced throughout the old-fashioned mortgages (45%) than simply bodies backed mortgage loans (36%) or first-date homebuyer applications (30%).

Given that anyone plan for and create fantasy belongings, discovering the fresh equipment and artwork may be the easiest part of processes. Deciding on the best capital options to help make their vision a facts can be a bit a lot more sensitive and painful to browse, told you Joye Hehn, Next step financial knowledge manager getting Places. Countries try purchased taking totally free systems and you can information that may assist book homebuyers and residents from the monetary decisions that suit their requirements and you can specifications.

Included in National Homeownership Times, Places Lender try reflecting free info that are available year-bullet to help home owners and homeowners discover and navigate the latest ins and outs off owning a home

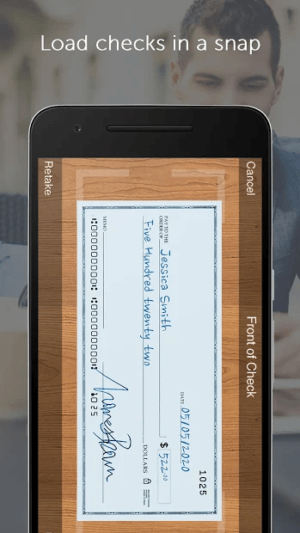

Self-paced Second step programs was obtainable thru a mobile device, pill otherwise pc. At exactly the same time, as part of Regions’ Each week Webinar Series, someone can sign up for the next lesson from Your own Path to Homeownership,’ and this dives loans Columbine Valley CO toward risks, obligations and you can rewards that come with homeownership. The full plan can be acquired right here, and new schedules is actually additional on a regular basis.

Such courses speak about the various version of fund and you can mortgages, home loan save selection, helpful tips toward setting up and you will keeping strong borrowing from the bank, while the requirement for borrowing from the bank towards the full economic health

- Do a restoration Funds: That have a comprehensive finances is essential when it comes down to upgrade. Has actually multiple designers quote on a venture before selecting you to, after which work at the new specialist so you’re able to finances information, labor, and extra will set you back instance it allows. Always booked an additional 10% to have rates overruns (age.grams., unexpected costs and you will expenses).